DEFINED BENEFIT (DB) REPORT:

ASSET MIX OF DB PLANS SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2022

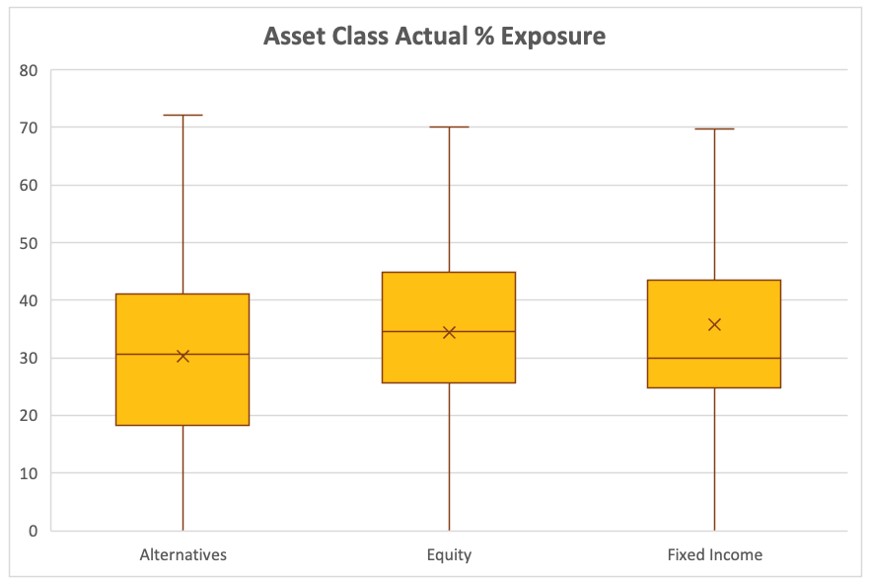

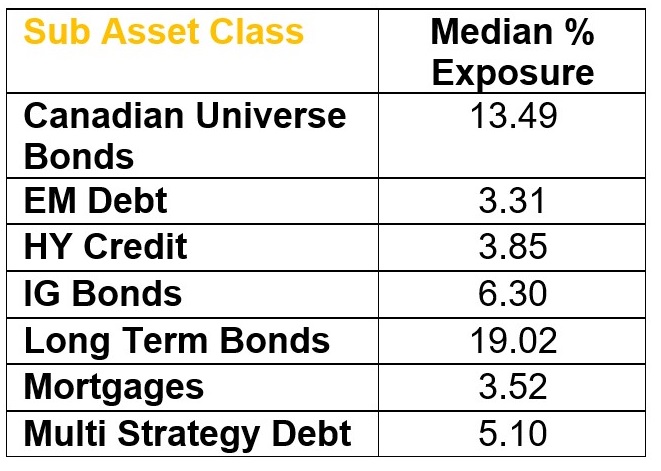

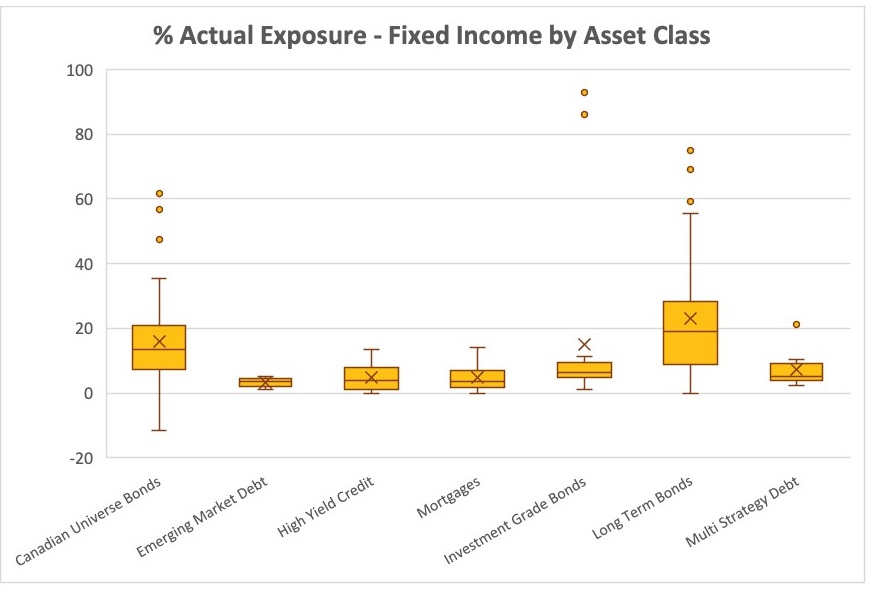

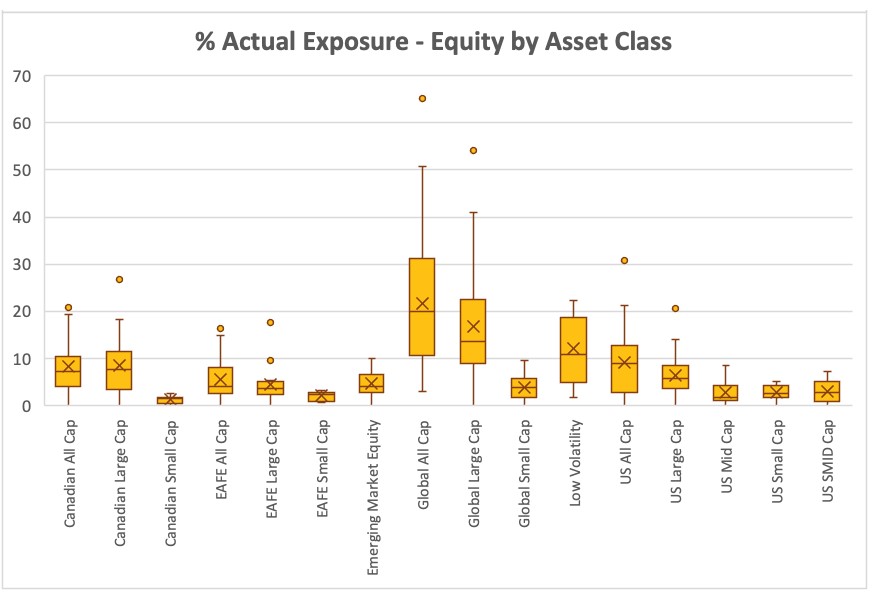

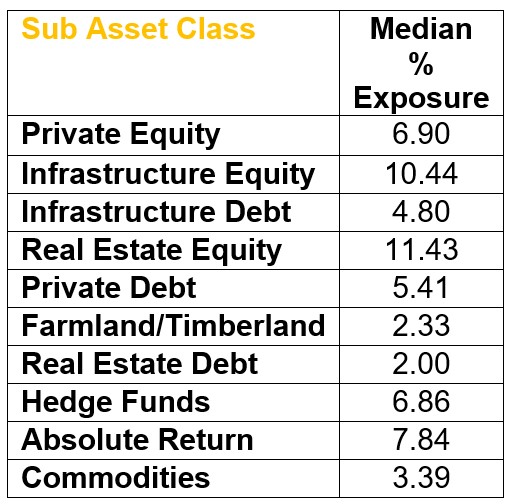

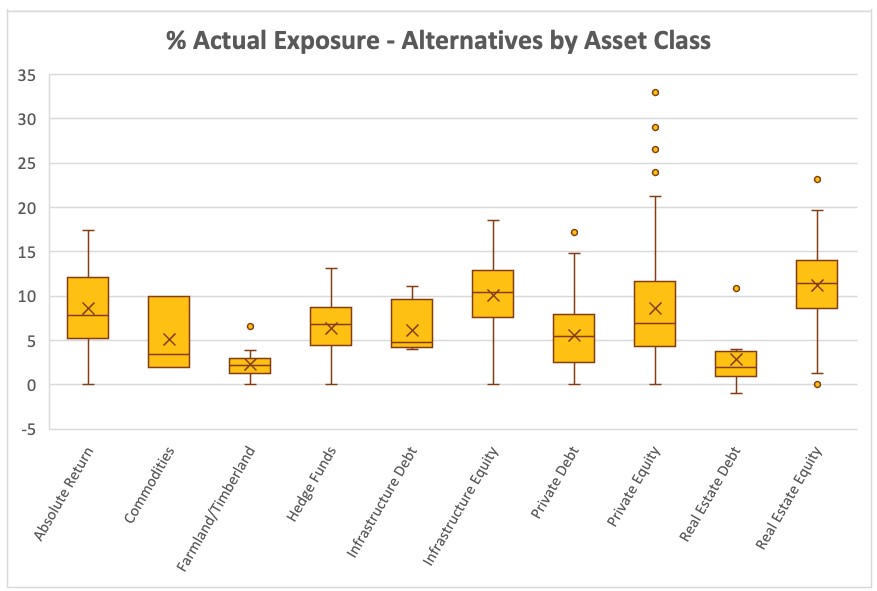

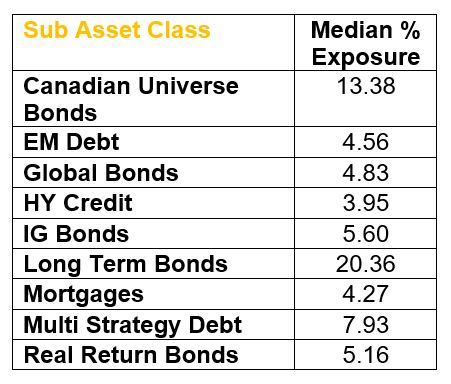

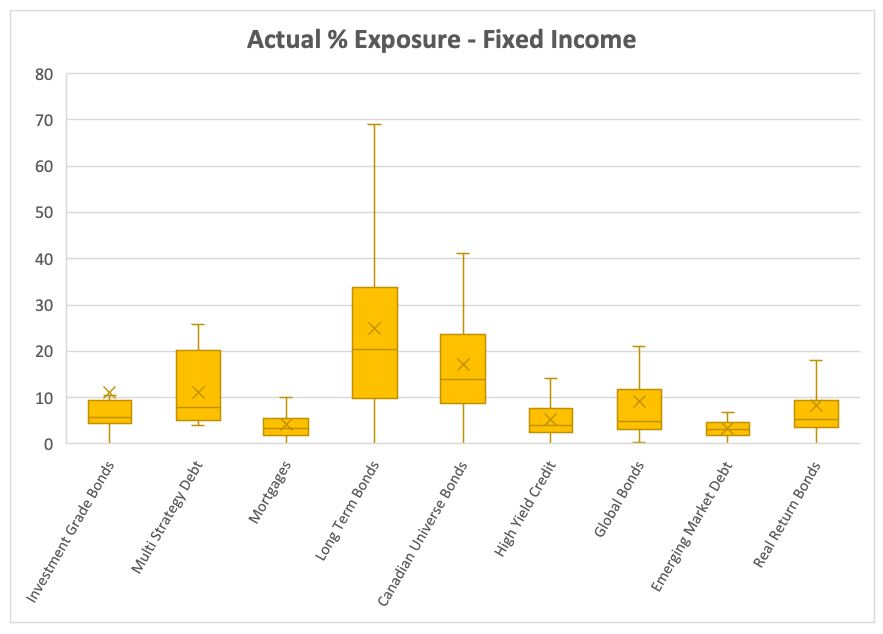

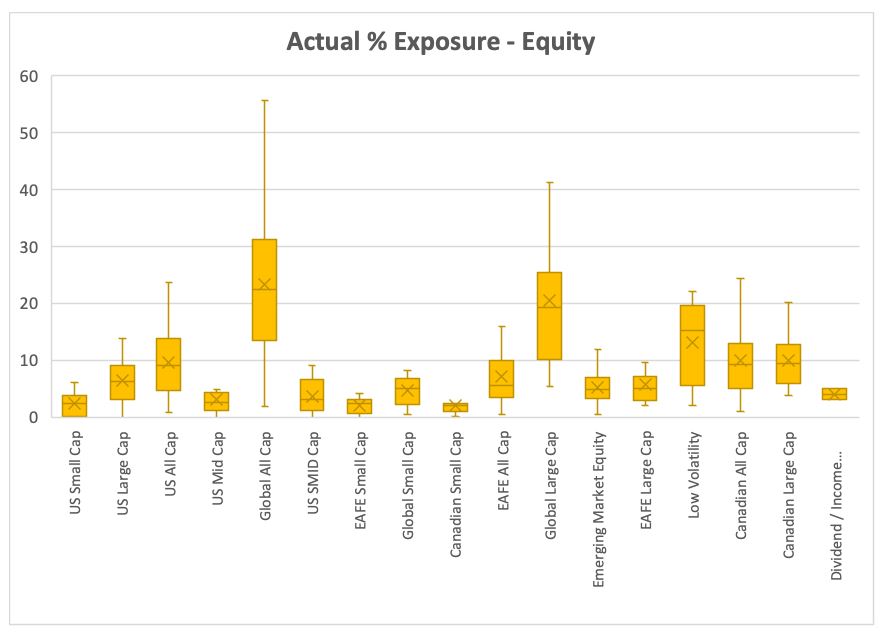

Below you will find box & whisker charts that provide the range of actual exposures to total and sub asset classes for all DB plans for the year ending December 31, 2022. The charts identify the largest and smallest exposure to each asset class as a percentage of each fund’s total asset mix noted by the lines attached to the box. You will also find the median exposure denoted with the middle line, and the top and bottom quartile denoted with the line at the top and bottom of each box. The ‘x’ mark identifies the average fund actual exposure. The survey covers all DB plans and represents total plan assets of $2,709B.

DEFINED CONTRIBUTION (DC) REPORT:

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2022:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 5,626.27 | 17.82% |

| TARGET RISK FUNDS | 12,996.00 | 41.17% |

| BALANCED FUNDS | 7,144.65 | 22.63% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 35.78 | 0.11% |

| MONEY MARKET | 1,056.57 | 3.35% |

| GIC'S | 209.90 | 0.66% |

| CDN NOMINAL BONDS (Long) | 65.30 | 0.21% |

| CDN NOMINAL BONDS (Universe) | 393.03 | 1.24% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 0.50 | 0.00% |

| GLOBAL FIXED INCOME | 34.30 | 0.11% |

| CANADIAN EQUITIES | 1,370.42 | 4.34% |

| US EQUITIES | 1,229.37 | 3.89% |

| EAFE EQUITIES | 293.86 | 0.93% |

| EM EQUITIES | 1.23 | 0.00% |

| GLOBAL EQUITIES | 1,039.69 | 3.29% |

| REAL ESTATE | 9.05 | 0.03% |

| ALTERNATIVE / OTHER | 63.60 | 0.20% |

| TOTAL ASSETS AT MARKET | 31,569.52 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $31,576.05 MILLION

DEFINED BENEFIT (DB) REPORT:

ASSET MIX OF DB PLANS SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2021

Below you will find box & whisker charts that provide the range of actual exposures to total and sub asset classes for all DB plans for the year ending December 31, 2021. The charts identify the largest and smallest exposure to each asset class as a percentage of each fund’s total asset mix noted by the lines attached to the box. You will also find the median exposure denoted with the middle line, and the top and bottom quartile denoted with the line at the top and bottom of each box. The ‘x’ mark identifies the average fund actual exposure. The survey covers all DB plans and represents total plan assets of $2,786B.

DEFINED CONTRIBUTION (DC) REPORT:

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2021:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 6,365.38 | 18.00% |

| TARGET RISK FUNDS | 14,389.14 | 40.68% |

| BALANCED FUNDS | 8,033.44 | 22.71% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 28.75 | 0.08% |

| MONEY MARKET | 963.68 | 2.72% |

| GIC'S | 221.26 | 0.63% |

| CDN NOMINAL BONDS (Long) | 78.95 | 0.22% |

| CDN NOMINAL BONDS (Universe) | 514.77 | 1.46% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 0.50 | 0.00% |

| GLOBAL FIXED INCOME | 60.80 | 0.17% |

| CANADIAN EQUITIES | 1,553,56 | 4.39% |

| US EQUITIES | 1,503.61 | 4.25% |

| EAFE EQUITIES | 352.99 | 1.00% |

| EM EQUITIES | 9.36 | 0.03% |

| GLOBAL EQUITIES | 1,226.90 | 3.47% |

| REAL ESTATE | 10.00 | 0.03% |

| ALTERNATIVE / OTHER | 53.20 | 0.15% |

| TOTAL ASSETS AT MARKET | 35,366.29 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $36,095.62 MILLION

ASSET MIX OF DB PLANS SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2021

Below you will find box & whisker charts that provide the range of actual exposures to total and sub asset classes for all DB plans for the year ending December 31, 2020. The charts identify the largest and smallest exposure to each asset class as a percentage of each fund’s total asset mix noted by the lines attached to the box. You will also find the median exposure denoted with the middle line, and the top and bottom quartile denoted with the line at the top and bottom of each box. The ‘x’ mark identifies the average fund actual exposure. Total PIAC member fund DB plan AUM was $2.454T at the end of 2020, up 7.4% from prior year (2019 - $2.286T).

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2020:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 5,957.54 | 17.99% |

| TARGET RISK FUNDS | 13,613.40 | 41.11% |

| BALANCED FUNDS | 7,245.95 | 21.88% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 27.68 | 0.08% |

| MONEY MARKET | 1,156.28 | 3.49% |

| GIC'S | 258.18 | 0.78% |

| CDN NOMINAL BONDS (Long) | 89.82 | 0.27% |

| CDN NOMINAL BONDS (Universe) | 674.07 | 2.04% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 0.85 | 0.00% |

| GLOBAL FIXED INCOME | 78.60 | 0.24% |

| CANADIAN EQUITIES | 1,346.43 | 4.07% |

| US EQUITIES | 1,195.63 | 3.61% |

| EAFE EQUITIES | 360.74 | 1.09% |

| EM EQUITIES | 4.18 | 0.01% |

| GLOBAL EQUITIES | 1,067.12 | 3.22% |

| REAL ESTATE | 10.77 | 0.03% |

| ALTERNATIVE / OTHER | 27.19 | 1.08% |

| TOTAL ASSETS AT MARKET | 33,114.43 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $33,220.43 MILLION

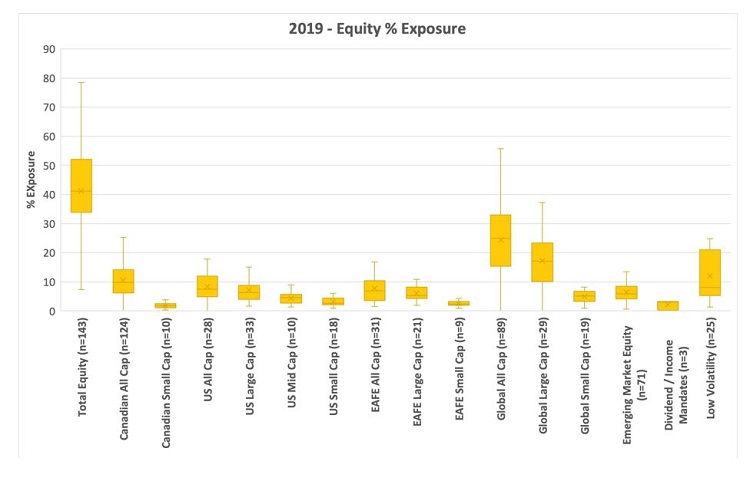

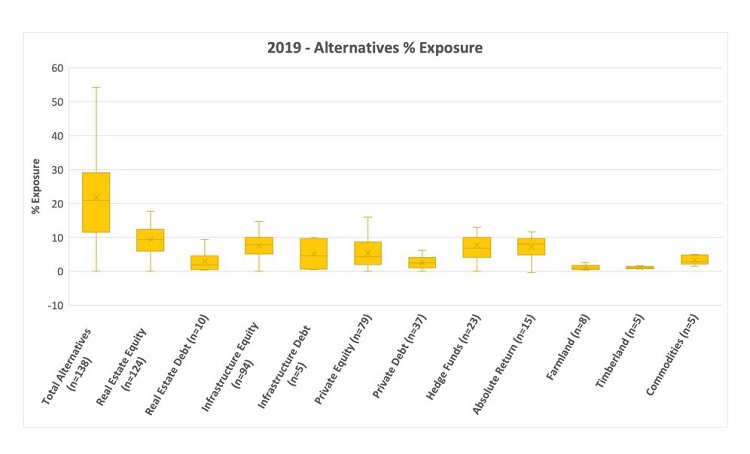

ASSET MIX OF DB PLANS SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2019

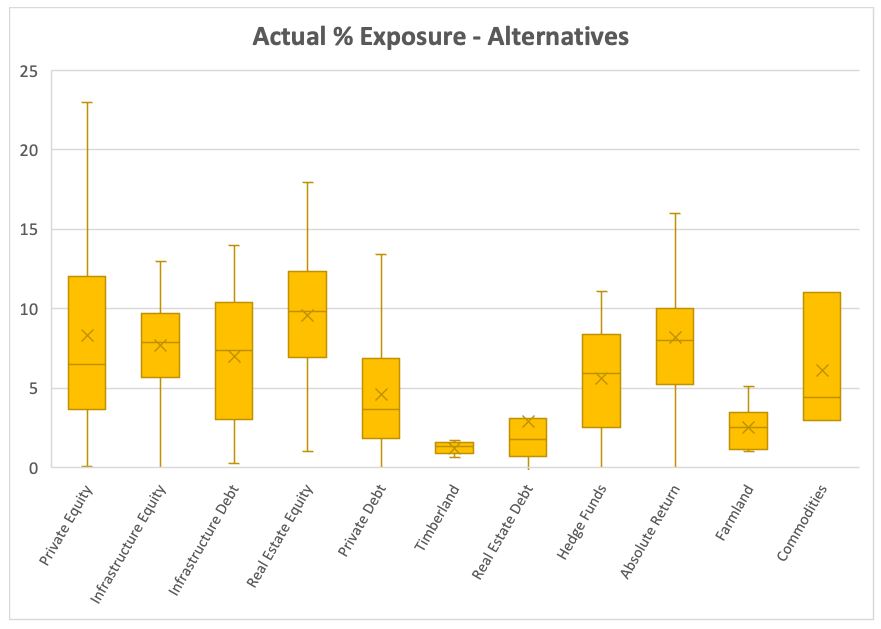

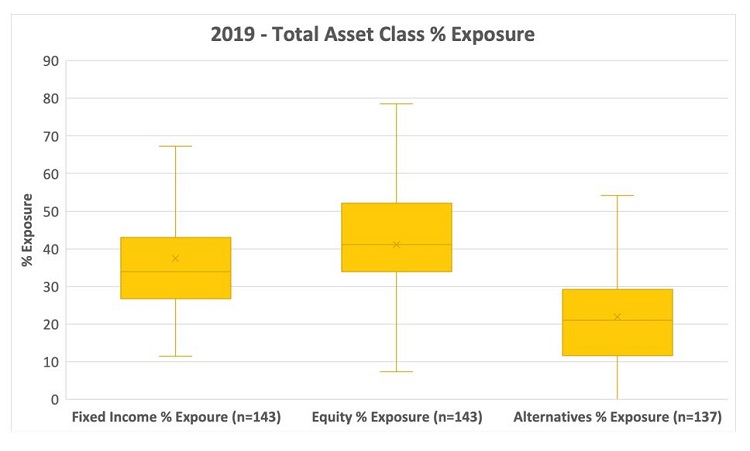

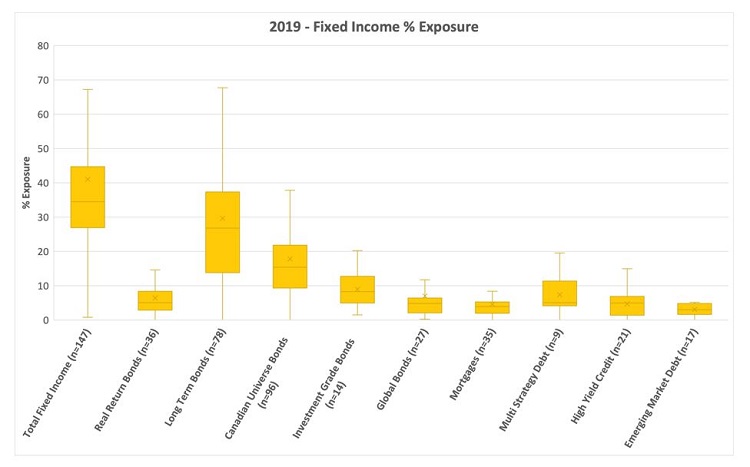

Below you will find box & whisker charts that provide the range of actual exposures to total and sub asset classes for all DB plans for the year ending December 31, 2019. The charts identify the largest and smallest exposure to each asset class as a percentage of each fund’s total asset mix noted by the lines attached to the box. You will also find the median exposure denoted with the middle line, and the top and bottom quartile denoted with the line at the top and bottom of each box. The ‘x’ mark identifies the average fund actual exposure. The number of participating responses for each asset class is with ‘n=’. Total PIAC member fund DB plan AUM was $2.286T.

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2019:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 3,056.39 | 10.40% |

| TARGET RISK FUNDS | 12,550.24 | 42.70% |

| BALANCED FUNDS | 6,869.64 | 23.37% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 21.67 | 0.07% |

| MONEY MARKET | 879.12 | 2.99% |

| GIC'S | 147.10 | 0.50% |

| CDN NOMINAL BONDS (Long) | 24.92 | 0.08% |

| CDN NOMINAL BONDS (Universe) | 841.73 | 2.86% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 15.00 | 0.05% |

| GLOBAL FIXED INCOME | 149.90 | 0.51% |

| CANADIAN EQUITIES | 1,421.11 | 4.83% |

| US EQUITIES | 934.56 | 3.18% |

| EAFE EQUITIES | 412.36 | 1.40% |

| EM EQUITIES | 154.44 | 0.53% |

| GLOBAL EQUITIES | 1,158.80 | 3.94% |

| REAL ESTATE | 195.30 | 0.66% |

| ALTERNATIVE / OTHER | 562.34 | 1.91% |

| TOTAL ASSETS AT MARKET | 29,394.62 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $30,701.72 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2018

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| POSITIVE CASH HOLDINGS | 36,140.16 | 1.72% |

| NEGATIVE CASH HOLDINGS | -119,380.91 | -5.70% |

| CANADIAN NOMINAL BONDS (Long) | 177,327.14 | 8.46% |

| CANADIAN NOMINAL BONDS (Universe) | 257,932.52 | 12.31% |

| REAL RETURN BONDS | 46,457.29 | 2.22% |

| MORTGAGES | 14,900.04 | 0.71% |

| FOREIGN FIXED INCOME | 135,640.63 | 6.47% |

| CANADIAN EQUITIES | 89,910.24 | 4.29% |

| U.S. EQUITIES | 41,276.35 | 1.97% |

| EAFE EQUITIES | 31,893.70 | 1.52% |

| EMERGING MARKETS EQUITIES | 75,237.77 | 3.59% |

| GLOBAL EQUITIES | 428,894.07 | 20.47% |

| REAL ESTATE | 267,687.16 | 12.78% |

| VENTURE CAPITAL/PRIVATE EQUITY | 260,382.35 | 12.43% |

| INFRASTRUCTURE | 170,857.54 | 8.15% |

| OTHER ASSETS | 144,325.76 | 6.89% |

| HEDGE FUNDS - used as part of portable alpha strategy | 8,884.44 | 0.42% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 26,972.09 | 1.29% |

| TOTAL ASSETS AT MARKET | 2,095,338.34 | 98.28% |

NOTE:

** The discrepancy between total assets at market and total assets of all DB funds is due to a rounding up of percentages in various asset categories or year-end allocations that total over 100%.

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $2,107,406.57 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2018:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 2,088.76 | 8.62% |

| TARGET RISK FUNDS | 10,100.88 | 41.67% |

| BALANCED FUNDS | 6,360.02 | 26.24% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 6.04 | 0.02% |

| MONEY MARKET | 441.07 | 1.82% |

| GIC'S | 424.63 | 1.75% |

| CDN NOMINAL BONDS (Long) | 29.25 | 0.12% |

| CDN NOMINAL BONDS (Universe) | 715.86 | 2.95% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 13.50 | 0.06% |

| GLOBAL FIXED INCOME | 115.89 | 0.48% |

| CANADIAN EQUITIES | 1,058.55 | 4.37% |

| US EQUITIES | 869.35 | 3.59% |

| EAFE EQUITIES | 540.08 | 2.23% |

| EM EQUITIES | 190.67 | 0.79% |

| GLOBAL EQUITIES | 585.98 | 2.42% |

| REAL ESTATE | 181.90 | 0.75% |

| ALTERNATIVE / OTHER | 520.00 | 2.14% |

| TOTAL ASSETS AT MARKET | 24,242.43 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $27,140.1 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2017

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -28,751.20 | -5.70% |

| CANADIAN NOMINAL BONDS (Long) | 177,327.14 | -1.36% |

| CANADIAN NOMINAL BONDS (Universe) | 238.559.10 | 11.28% |

| REAL RETURN BONDS | 50,461.30 | 2.39% |

| MORTGAGES | 13,667.30 | 0.65% |

| FOREIGN FIXED INCOME | 118,852.00 | 5.62% |

| CANADIAN EQUITIES | 123,823.50 | 2.10% |

| U.S. EQUITIES | 44,390.10 | 2.10% |

| EAFE EQUITIES | 36,380.60 | 1.72% |

| EMERGING MARKETS EQUITIES | 69,081.90 | 3.27% |

| GLOBAL EQUITIES | 496,538.40 | 23.48% |

| REAL ESTATE | 245,795.40 | 11.62% |

| VENTURE CAPITAL/PRIVATE EQUITY | 209,605.20 | 9.91% |

| INFRASTRUCTURE | 150,331.30 | 7.11% |

| OTHER ASSETS | 106,131.30 | 5.02% |

| HEDGE FUNDS - used as part of portable alpha strategy | 7,522.80 | 0.36% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 27,467.61 | 1.30% |

| TOTAL ASSETS AT MARKET | 2,114,937.51 | 100% |

NOTE:

** The discrepancy between total assets at market and total assets of all DB funds is due to a rounding up of percentages in various asset categories or year-end allocations that total over 100%.

** TOTAL ASSETS OF ALL DB FUNDS $2,110,960.40 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2017:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 2,191.63 | 8.04% |

| TARGET RISK FUNDS | 11,127.67 | 40.82% |

| BALANCED FUNDS | 6,744.03 | 24.74% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 7.62 | 0.03% |

| MONEY MARKET | 771.01 | 2.83% |

| GIC'S | 137.71 | 0.51 |

| CDN NOMINAL BONDS (Long) | 71.90 | 0.26% |

| CDN NOMINAL BONDS (Universe) | 830.10 | 3.04% |

| CDN REAL RETURN BONDS | 0.05 | 0.00% |

| CDN MORTGAGES | 0.5 | 0.00% |

| GLOBAL FIXED INCOME | 93.00 | 0.34% |

| CANADIAN EQUITIES | 1,495.40 | 5.49% |

| US EQUITIES | 914.17 | 3.35% |

| EAFE EQUITIES | 596.57 | 2.19% |

| EM EQUITIES | 211.10 | 0.77% |

| GLOBAL EQUITIES | 668.31 | 2.45% |

| REAL ESTATE | 175.55 | 0.64% |

| ALTERNATIVE / OTHER | 1,225.90 | 4.5% |

| TOTAL ASSETS AT MARKET | 27,262.22 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** ~35% OF THE ASSETS BELONG TO ONE PLAN

** TOTAL ASSETS OF ALL DC FUNDS $27,541.38 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2016

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -9,794.30 | -0.54% |

| CANADIAN NOMINAL BONDS | 382,694.90 | 20.92% |

| REAL RETURN BONDS | 53,344.95 | 2.92% |

| MORTGAGES | 21,581.60 | 1.18% |

| FOREIGN FIXED INCOME | 67,345.10 | 3.68% |

| CANADIAN EQUITIES | 130,844.90 | 7.16% |

| U.S. EQUITIES | 59,747.50 | 3.27% |

| EAFE EQUITIES | 42,736.60 | 2.34% |

| EMERGING MARKETS EQUITIES | 56,527.10 | 3.09% |

| GLOBAL EQUITIES | 364,326.50 | 19.93% |

| REAL ESTATE | 214,967.50 | 11.62% |

| VENTURE CAPITAL/PRIVATE EQUITY | 176,979.84 | 9.68% |

| INFRASTRUCTURE | 127,333.60 | 6.97% |

| OTHER ASSETS | 106,127.60 | 5.81% |

| HEDGE FUNDS - used as part of portable alpha strategy | 10,675.04 | 0.58% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 22,210.70 | 1.22% |

| TOTAL ASSETS AT MARKET | 1,827,649.18 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $1,839,859.90 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2016:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 1,913.56 | 7.38% |

| TARGET RISK FUNDS | 10,091.26 | 38.93% |

| BALANCED FUNDS | 7,288.73 | 28.12% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 3.13 | 0.01% |

| MONEY MARKET | 832.85 | 3.21% |

| GIC'S | 141.50 | 0.55 |

| CDN NOMINAL BONDS | 887.72 | 3.42% |

| CDN REAL RETURN BONDS | 0.13 | 0.00% |

| CDN MORTGAGES | 0.65 | 0.00% |

| GLOBAL FIXED INCOME | 111.33 | 0.43% |

| CANADIAN EQUITIES | 1,392.14 | 5.37% |

| US EQUITIES | 816.54 | 3.15% |

| EAFE EQUITIES | 488.80 | 1.89% |

| EM EQUITIES | 172.20 | 0.66% |

| GLOBAL EQUITIES | 543.76 | 2.10% |

| REAL ESTATE | 3.26 | 0.01% |

| ALTERNATIVE / OTHER | 1,231.30 | 4.75% |

| TOTAL ASSETS AT MARKET | 25,918.86 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $26,368.81 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2015

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -7,860.89 | -0.50% |

| CANADIAN NOMINAL BONDS | 357,838.37 | 22.60% |

| REAL RETURN BONDS | 50,085.63 | 3.16% |

| MORTGAGES | 18,595.23 | 1.17% |

| FOREIGN FIXED INCOME | 55,887.54 | 3.53% |

| CANADIAN EQUITIES | 138,055.57 | 8.72% |

| U.S. EQUITIES | 75,662.52 | 4.78% |

| EAFE EQUITIES | 59,551.40 | 3.76% |

| EMERGING MARKETS EQUITIES | 65,295.60 | 4.12% |

| GLOBAL EQU262,538.74ITIES | 262,538.74 | 16.58% |

| REAL ESTATE | 173,548.62 | 10.96% |

| VENTURE CAPITAL/PRIVATE EQUITY | 151,721.50 | 9.58% |

| INFRASTRUCTURE | 88,469.00 | 5.59% |

| OTHER ASSETS | 58,947.40 | 3.72% |

| HEDGE FUNDS - used as part of portable alpha strategy | 11,083.52 | 0.70% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 23,794.17 | 1.50% |

| TOTAL ASSETS AT MARKET | 1,583,213.92 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $1,583,213.92 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2015:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 1,730.26 | 7.38% |

| TARGET RISK FUNDS | 9,547.87 | 40.71% |

| BALANCED FUNDS | 6,253.75 | 26.66% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 3.96 | 0.02% |

| MONEY MARKET | 798.87 | 3.41% |

| GIC'S | 132.73 | 0.57% |

| CDN NOMINAL BONDS | 833.00 | 3.55% |

| CDN REAL RETURN BONDS | 28.91 | 0.12% |

| CDN MORTGAGES | 0.54 | 0.00% |

| GLOBAL FIXED INCOME | 111.02 | 0.47% |

| CANADIAN EQUITIES | 1,262.71 | 5.38% |

| US EQUITIES | 884.81 | 3.77% |

| EAFE EQUITIES | 526.63 | 2.25% |

| EM EQUITIES | 158.00 | 0.67% |

| GLOBAL EQUITIES | 489.61 | 2.09% |

| REAL ESTATE | 187.54 | 2.09% |

| ALTERNATIVE / OTHER | 503.00 | 2.14% |

| TOTAL ASSETS AT MARKET | 23,453.21 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $24,674.13 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2014

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 5,461.30 | 0.36% |

| CANADIAN NOMINAL BONDS | 355,513.50 | 23.61% |

| REAL RETURN BONDS | 48,253.30 | 3.20% |

| MORTGAGES | 17,374.30 | 1.15% |

| FOREIGN FIXED INCOME | 18,962.60 | 1.26% |

| CANADIAN EQUITIES | 161,197.30 | 10.71% |

| U.S. EQUITIES | 72,400.00 | 4.81% |

| EAFE EQUITIES | 54,663.80 | 3.63% |

| EMERGING MARKETS EQUITIES | 60,295.00 | 4.00% |

| GLOBAL EQU262,538.74ITIES | 224,498.20 | 14.91% |

| REAL ESTATE | 157,973.70 | 10.49% |

| VENTURE CAPITAL/PRIVATE EQUITY | 121,955.60 | 8.10% |

| INFRASTRUCTURE | 75,327.30 | 5.00% |

| OTHER ASSETS | 100,706.20 | 6.69% |

| HEDGE FUNDS - used as part of portable alpha strategy | 10,057.10 | 0.67% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 21,151.80 | 1.40% |

| TOTAL ASSETS AT MARKET | 1,505,791.00 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $1,518,153.00 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2014:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 1,508.61 | 5.74% |

| TARGET RISK FUNDS | 8,037.35 | 30.56% |

| BALANCED FUNDS | 5,998.52 | 22.81% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 35.91 | 0.14% |

| MONEY MARKET | 824.16 | 3.13% |

| GIC'S | 154.09 | 0.59% |

| CDN NOMINAL BONDS | 3,118.23 | 11.86% |

| CDN REAL RETURN BONDS | 413.08 | 1.57% |

| CDN MORTGAGES | 0.64 | 0.00% |

| GLOBAL FIXED INCOME | 98.40 | 0.37% |

| CANADIAN EQUITIES | 2,124.09 | 8.08% |

| US EQUITIES | 886.94 | 3.37% |

| EAFE EQUITIES | 557.17 | 2.12% |

| EM EQUITIES | 147.50 | 0.56% |

| GLOBAL EQUITIES | 895.24 | 3.40% |

| REAL ESTATE | 164.69 | 0.63% |

| ALTERNATIVE / OTHER | 1,334.40 | 5.07% |

| TOTAL ASSETS AT MARKET | 26,299.02 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $26,693.94 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2013

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -10,830.01 | -0.85% |

| CANADIAN NOMINAL BONDS | 296,111.65 | 23.31% |

| REAL RETURN BONDS | 38,421.46 | 3.02% |

| MORTGAGES | 14,526.49 | 1.14% |

| FOREIGN FIXED INCOME | 15,147.46 | 1.19% |

| CANADIAN EQUITIES | 151,101.40 | 11.89% |

| U.S. EQUITIES | 61,262.29 | 4.82% |

| EAFE EQUITIES | 49,650.30 | 3.91% |

| EMERGING MARKETS EQUITIES | 51,413.73 | 4.05% |

| GLOBAL EQU262,538.74ITIES | 202,411.56 | 15.93% |

| REAL ESTATE | 132,265.22 | 10.41% |

| VENTURE CAPITAL/PRIVATE EQUITY | 101,270.28 | 7.97% |

| INFRASTRUCTURE | 63,083.66 | 4.97% |

| OTHER ASSETS | 79,015.48 | 6.22% |

| HEDGE FUNDS - used as part of portable alpha strategy | 5,863.21 | 0.46% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 19,766.79 | 1.56% |

| TOTAL ASSETS AT MARKET | 1,270,480.97 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $1,279,585.3 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2013:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 1,054.18 | 5.55% |

| TARGET RISK FUNDS | 7,875.41 | 41.47% |

| BALANCED FUNDS | 5,036.56 | 26.52% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 0.60 | 0.00% |

| MONEY MARKET | 557.99 | 2.94% |

| GIC'S | 126.97 | 0.67% |

| CDN NOMINAL BONDS | 1,381.70 | 7.28% |

| CDN REAL RETURN BONDS | 0.00 | 0.00% |

| CDN MORTGAGES | 0.50 | 0.00% |

| GLOBAL FIXED INCOME | 85.22 | 0.45% |

| CANADIAN EQUITIES | 1,325.70 | 6.98% |

| US EQUITIES | 528.69 | 2.78% |

| EAFE EQUITIES | 482.75 | 2.54% |

| EM EQUITIES | 130.90 | 0.69% |

| GLOBAL EQUITIES | 267.22 | 1.41% |

| REAL ESTATE | 137.60 | 0.72% |

| ALTERNATIVE / OTHER | 0.00 | 0.00% |

| TOTAL ASSETS AT MARKET | 18,991.49 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $22,891.19 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2012

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -20,459.00 | -1.77% |

| CANADIAN NOMINAL BONDS | 294,416.80 | 25.41% |

| REAL RETURN BONDS | 59,910.10 | 5.17% |

| MORTGAGES | 6,304.00 | 0.54% |

| FOREIGN FIXED INCOME | 17,182.50 | 1.48% |

| CANADIAN EQUITIES | 150,517.90 | 12.99% |

| U.S. EQUITIES | 66,370.80 | 5.73% |

| EAFE EQUITIES | 52,777.90 | 4.56% |

| EMERGING MARKETS EQUITIES | 46,012.60 | 3.97% |

| GLOBAL EQU262,538.74ITIES | 161,958.20 | 13.98% |

| REAL ESTATE | 117,560.00 | 10.15% |

| VENTURE CAPITAL/PRIVATE EQUITY | 86,041.00 | 7.43% |

| INFRASTRUCTURE | 57,333.90 | 4.95% |

| OTHER ASSETS | 43,735.70 | 3.77% |

| HEDGE FUNDS - used as part of portable alpha strategy | 6,614.10 | 0.57% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 12,380.70 | 1.07% |

| TOTAL ASSETS AT MARKET | 1,158,657.20 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DB FUNDS $1,162,991.2 MILLION

ASSET MIX OF DC PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2012:

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| TARGET DATE FUNDS | 838.90 | 4.26% |

| TARGET RISK FUNDS | 6,200.50 | 31.52% |

| BALANCED FUNDS | 4,322.40 | 21.97% |

STAND ALONE FUNDS |

||

| CASH & DAILY INTEREST | 118.40 | 0.60% |

| MONEY MARKET | 2,201.70 | 11.19% |

| GIC'S | 120.20 | 0.61% |

| CDN NOMINAL BONDS | 1,622.90 | 8.25% |

| CDN REAL RETURN BONDS | 344.00 | 1.75% |

| GLOBAL FIXED INCOME | 89.90 | 0.46% |

| CANADIAN EQUITIES | 1,768.80 | 8.99% |

| US EQUITIES | 743.10 | 3.78% |

| EAFE EQUITIES | 582.20 | 2.96% |

| EM EQUITIES | 126.30 | 0.64% |

| GLOBAL EQUITIES | 306.20 | 1.56% |

| REAL ESTATE | 108.20 | 0.55% |

| ALTERNATIVE / OTHER | 180.00 | 0.91% |

| TOTAL ASSETS AT MARKET | 19,673.70 | 100.00% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL DC FUNDS $19,999.90 MILLION

ASSET MIX OF DB PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2011

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -18,112.50 | -1.77% |

| CANADIAN NOMINAL BONDS | 284,484.70 | 27.10% |

| REAL RETURN BONDS | 49,705.20 | 4.74% |

| MORTGAGES | 6,248.30 | 0.60% |

| FOREIGN FIXED INCOME | 18,315.40 | 1.75% |

| CANADIAN EQUITIES | 158,074.40 | 15.06% |

| U.S. EQUITIES | 59,065.70 | 5.63% |

| EAFE EQUITIES | 45,712.40 | 4.36% |

| EMERGING MARKETS EQUITIES | 28,768.30 | 2.74% |

| GLOBAL EQUITIES | 146,112.00 | 13.92% |

| REAL ESTATE | 98,972.70 | 9.43% |

| VENTURE CAPITAL/PRIVATE EQUITY | 75,926.70 | 7.23% |

| INFRASTRUCTURE | 47,993.80 | 4.57% |

| OTHER ASSETS | 30,649.60 | 2.92% |

| HEDGE FUNDS - used as part of portable alpha strategy | 5,396.50 | 0.51% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 12,274.80 | 1.17% |

| TOTAL ASSETS AT MARKET | 1,049,588.00 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $1,088,314.6 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2010

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | -15,428.40 | -1.52% |

| CANADIAN NOMINAL BONDS | 266,013.70 | 26.20% |

| REAL RETURN BONDS | 46,502.70 | 4.58% |

| MORTGAGES | 7,027.70 | 0.69% |

| FOREIGN FIXED INCOME | 17,825.70 | 1.76% |

| CANADIAN EQUITIES | 162,382.40 | 15.99% |

| U.S. EQUITIES | 62,389.20 | 6.14% |

| EAFE EQUITIES | 59,313.60 | 5.84% |

| EMERGING MARKETS EQUITIES | 30,980.30 | 3.05% |

| GLOBAL EQUITIES | 126,129.70 | 12.42% |

| REAL ESTATE | 89,938.00 | 8.86% |

| VENTURE CAPITAL/PRIVATE EQUITY | 73,504.70 | 7.24% |

| INFRASTRUCTURE | 42,141.60 | 4.15% |

| OTHER ASSETS | 30,266.50 | 2.98% |

| HEDGE FUNDS - used as part of portable alpha strategy | 4,631.10 | 0.46% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 11,810.00 | 1.16% |

| TOTAL ASSETS AT MARKET | 1,015,428.50 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $1,017,035.60 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2009

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 1,376.00 | 0.15% |

| CANADIAN NOMINAL BONDS | 233,762.90 | 25.67% |

| REAL RETURN BONDS | 42,692.40 | 4.69% |

| MORTGAGES | 6,253.00 | 0.69% |

| FOREIGN FIXED INCOME | 16,778.50 | 1.84% |

| CANADIAN EQUITIES | 144,636.40 | 15.88% |

| U.S. EQUITIES | 58,245.90 | 6.40% |

| EAFE EQUITIES | 56,799.20 | 6.24% |

| EMERGING MARKETS EQUITIES | 21,184.90 | 2.33% |

| GLOBAL EQUITIES | 118,615.10 | 13.03% |

| REAL ESTATE | 81,157.90 | 8.91% |

| VENTURE CAPITAL/PRIVATE EQUITY | 54,409.00 | 5.97% |

| INFRASTRUCTURE | 34,960.60 | 3.84% |

| OTHER ASSETS | 22,018.80 | 2.42% |

| HEDGE FUNDS - used as part of portable alpha strategy | 5,243.40 | 0.58% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 12,490.50 | 1.37% |

| TOTAL ASSETS AT MARKET | 910,624.50 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $911,633.7 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2008

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 2,787.00 | 0.34% |

| CANADIAN NOMINAL BONDS | 231,452.50 | 26.38% |

| REAL RETURN BONDS | 35,865.50 | 4.40% |

| MORTGAGES | 6,756.50 | 0.83% |

| FOREIGN FIXED INCOME | 14,623.00 | 1.79% |

| CANADIAN EQUITIES | 118,020.30 | 14.47% |

| U.S. EQUITIES | 54,450.70 | 6.68% |

| EAFE EQUITIES | 53,620.70 | 6.57% |

| EMERGING MARKETS EQUITIES | 7,841.30 | 0.96% |

| GLOBAL EQUITIES | 84,545.60 | 10.37% |

| REAL ESTATE | 81,880.90 | 10.04% |

| VENTURE CAPITAL/PRIVATE EQUITY | 52,127.30 | 6.39% |

| INFRASTRUCTURE | 29,311.80 | 3.59% |

| OTHER ASSETS | 21,870.80 | 2.68% |

| HEDGE FUNDS - used as part of portable alpha strategy | 4,355.20 | 0.53% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 16,103.60 | 1.97% |

| TOTAL ASSETS AT MARKET | 815,612.70 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $873,185.5 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2007

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 15,545.80 | 1.9% |

| CANADIAN NOMINAL BONDS | 217,791.30 | 26.7% |

| REAL RETURN BONDS | 21,910.20 | 2.7% |

| MORTGAGES | 7,353.80 | 0.9% |

| FOREIGN FIXED INCOME | 3,149.30 | 0.4% |

| CANADIAN EQUITIES | 156,602.80 | 19.2% |

| U.S. EQUITIES | 68,780.00 | 8.4% |

| EAFE EQUITIES | 78,535.40 | 9.6% |

| EMERGING MARKETS EQUITIES | 10,084.30 | 1.2% |

| GLOBAL EQUITIES | 87,697.70 | 9.0% |

| REAL ESTATE | 73,092.30 | 9.0% |

| VENTURE CAPITAL/PRIVATE EQUITY | 34,670.70 | 4.3% |

| INFRASTRUCTURE | 15,882.10 | 1.9% |

| OTHER ASSETS | 11,118.40 | 2.68% |

| HEDGE FUNDS - used as part of portable alpha strategy | 4,687.70 | 0.6% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 7,717.10 | 0.9% |

| TOTAL ASSETS AT MARKET | 814,681.90 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $942,943.6 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2006

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 6,557.5 | 0.8% |

| CANADIAN NOMINAL BONDS | 212,813.1 | 24.4% |

| REAL RETURN BONDS | 29,305.4 | 3.4% |

| MORTGAGES | 14,044.9 | 1.6% |

| FOREIGN FIXED INCOME | 8,781.3 | 1.0% |

| CANADIAN EQUITIES | 173,679.5 | 19.9% |

| U.S. EQUITIES | 72,087.5 | 8.3% |

| EAFE EQUITIES | 77,394.0 | 8.9% |

| EMERGING MARKETS EQUITIES | 7,993.5 | 0.9% |

| GLOBAL EQUITIES | 121,697.3 | 13.9% |

| REAL ESTATE | 63,233.7 | 7.2% |

| VENTURE CAPITAL/PRIVATE EQUITY | 30,472.7 | 3.5% |

| INFRASTRUCTURE | 20,964.5 | 2.4% |

| OTHER ASSETS | 14,064.0 | 1.6% |

| HEDGE FUNDS - used as part of portable alpha strategy | 3,539.3 | 0.4% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 16,081.7 | 1.8% |

| TOTAL ASSETS AT MARKET | 872,709.9 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $909,543.1 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2005

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 24,434.8 | 3.5% |

| CANADIAN NOMINAL BONDS | 184,153.1 | 26.2% |

| REAL RETURN BONDS | 26,798.8 | 3.8% |

| MORTGAGES | 10,981 | 1.6% |

| FOREIGN FIXED INCOME | 4,230.6 | 0.6% |

| CANADIAN EQUITIES | 168,585.7 | 24.0% |

| U.S. EQUITIES | 53,979.4 | 7.7% |

| EAFE EQUITIES | 56,785.1 | 8.1% |

| EMERGING MARKETS EQUITIES | 2,854.2 | 0.4% |

| GLOBAL EQUITIES | 59,888.7 | 8.5% |

| REAL ESTATE | 50,270 | 7.2% |

| VENTURE CAPITAL/PRIVATE EQUITY | 27,756.2 | 4.0% |

| OTHER ASSETS | 17,934.4 | 2.6% |

| HEDGE FUNDS - used as part of portable alpha strategy | 2,000.4 | 0.3% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 11,839.2 | 1.7% |

| TOTAL ASSETS AT MARKET | 702,491.6 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $794,138.4 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2004

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 18,555.1 | 2.9% |

| CANADIAN NOMINAL BONDS | 174,090.9 | 27.0% |

| REAL RETURN BONDS | 24,143.4 | 3.7% |

| MORTGAGES | 9,865.9 | 1.5% |

| FOREIGN FIXED INCOME | 5,001.6 | 0.8% |

| CANADIAN EQUITIES | 153,967.4 | 23.9% |

| U.S. EQUITIES | 70,494.9 | 10.9% |

| EAFE EQUITIES | 55,288.6 | 8.6% |

| EMERGING MARKETS EQUITIES | 3,145.1 | 0.5% |

| GLOBAL EQUITIES | 53,481.3 | 8.3% |

| REAL ESTATE | 36,703.0 | 5.7% |

| VENTURE CAPITAL/PRIVATE EQUITY | 22,045.1 | 3.4% |

| OTHER ASSETS | 9,336.7 | 1.4% |

| HEDGE FUNDS - used as part of portable alpha strategy | 934.1 | 0.1% |

| HEDGE FUNDS - not used as part of portable alpha strategy | 8,158.6 | 1.3% |

| TOTAL ASSETS AT MARKET | 645,211.7 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $693,631.2 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2003

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 12,185.9 | 2.4% |

| CANADIAN NOMINAL BONDS | 142,227.1 | 27.9% |

| REAL RETURN BONDS | 17,107.0 | 3.4% |

| MORTGAGES | 8,956.2 | 1.8% |

| FOREIGN FIXED INCOME | 2,305.6 | 0.5% |

| CANADIAN EQUITIES | 116,299.0 | 22.8% |

| U.S. EQUITIES | 62,919.9 | 12.4% |

| EAFE EQUITIES | 48,117.4 | 9.5% |

| EMERGING MARKETS EQUITIES | 1,787.4 | 0.4% |

| GLOBAL EQUITIES | 36,436.2 | 7.2% |

| REAL ESTATE | 33,885.1 | 6.7% |

| VENTURE CAPITAL/PRIVATE EQUITY | 18,123.0 | 3.6% |

| OTHER ASSETS | 8,791.9 | 1.7% |

| TOTAL ASSETS AT MARKET | 509,141.7 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $595,450.1 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2002

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 14,150.8 | 2.8% |

| CANADIAN NOMINAL BONDS | 164,388.8 | 32.1% |

| REAL RETURN BONDS | 14,804.3 | 2.9% |

| MORTGAGES | 7,872.7 | 1.5% |

| FOREIGN FIXED INCOME | 2,547.8 | 0.5% |

| CANADIAN EQUITIES | 114,811.7 | 22.4% |

| U.S. EQUITIES | 53,445.5 | 10.4% |

| EAFE EQUITIES | 43,315.1 | 8.5% |

| EMERGING MARKETS EQUITIES | 1,573.5 | 0.3% |

| GLOBAL EQUITIES | 30,940.2 | 6.0% |

| REAL ESTATE | 36,198.9 | 7.1% |

| VENTURE CAPITAL/PRIVATE EQUITY | 18,010.3 | 3.5% |

| OTHER ASSETS | 9,753.3 | 1.9% |

| TOTAL ASSETS AT MARKET | 511,812.9 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $536,910.0 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2001

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 8,980.1 | 1.8% |

| CANADIAN NOMINAL BONDS | 136,314.1 | 28.0% |

| REAL RETURN BONDS | 12,148.5 | 2.5% |

| MORTGAGES | 8,033.4 | 1.6% |

| FOREIGN FIXED INCOME | 3,214.1 | 0.7% |

| CANADIAN EQUITIES | 129,388.1 | 26.5% |

| U.S. EQUITIES | 59,498.6 | 12.2% |

| EAFE EQUITIES | 44,132.9 | 9.1% |

| EMERGING MARKETS EQUITIES | 3,778.6 | 0.8% |

| GLOBAL EQUITIES | 38,866.4 | 8.0% |

| REAL ESTATE | 30,319.4 | 6.2% |

| VENTURE CAPITAL/PRIVATE EQUITY | 8,469.9 | 1.7% |

| OTHER ASSETS | 4,309.9 | 0.9% |

| TOTAL ASSETS AT MARKET | 487,454.0 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $528,460.8 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 2000

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 13,564.6 | 2.6% |

| CANADIAN NOMINAL BONDS | 154,859.3 | 29.5% |

| REAL RETURN BONDS | 13,541.2 | 2.6% |

| MORTGAGES | 8,216.1 | 1.6% |

| FOREIGN FIXED INCOME | 6,576.3 | 1.3% |

| CANADIAN EQUITIES | 146,046.8 | 27.9% |

| U.S. EQUITIES | 55,180.5 | 10.5% |

| EAFE EQUITIES | 42,083.0 | 8.0% |

| EMERGING MARKETS EQUITIES | 2,548.9 | 0.5% |

| GLOBAL EQUITIES | 41,898.9 | 8.0% |

| REAL ESTATE | 27,354.8 | 5.2% |

| VENTURE CAPITAL/PRIVATE EQUITY | 8,004.6 | 1.5% |

| OTHER ASSETS | 4,428.1 | 0.8% |

| TOTAL ASSETS AT MARKET | 524,303.1 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $554,052.7 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1999

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 11,841.5 | 2.3% |

| DOMESTIC BONDS | 153,665.5 | 30.4% |

| FOREIGN BONDS | 4,098.7 | 0.8% |

| MORTGAGES | 7,738.2 | 1.5% |

| REAL ESTATE | 19,987.0 | 4.0% |

| CANADIAN EQUITIES | 164,528.1 | 32.6% |

| U.S. EQUITIES | 51,460.3 | 10.2% |

| INTERNATIONAL EQUITIES | 75,400.2 | 14.9% |

| OTHER ASSETS | 16,702.0 | 3.3% |

| TOTAL ASSETS AT MARKET | 505,421.5 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $510,409.6 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1998

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 12,218.5 | 2.8% |

| DOMESTIC BONDS | 150,985.5 | 34.6% |

| FOREIGN BONDS | 3,927.4 | 0.9% |

| MORTGAGES | 7,418.4 | 1.7% |

| REAL ESTATE | 16,145.8 | 3.7% |

| CANADIAN EQUITIES | 128,294.0 | 29.4% |

| U.S. EQUITIES | 46,255.7 | 10.6% |

| INTERNATIONAL EQUITIES | 62,401.5 | 14.3% |

| OTHER ASSETS | 8,727.5 | 2.0% |

| TOTAL ASSETS AT MARKET | 436,374.3 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $444,545.5 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1997

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 15,983.0 | 3.8% |

| DOMESTIC BONDS | 139,220.5 | 33.1% |

| FOREIGN BONDS | 3,364.8 | 0.8% |

| MORTGAGES | 7,150.3 | 1.7% |

| REAL ESTATE | 15,562.4 | 3.7% |

| CANADIAN EQUITIES | 137,958.6 | 32.8% |

| U.S. EQUITIES | 43,322.4 | 10.3% |

| INTERNATIONAL EQUITIES | 52,155.1 | 12.4% |

| OTHER ASSETS | 5,888.5 | 1.4% |

| TOTAL ASSETS AT MARKET | 420,605.6 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $423,287.2 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1996

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 17,392.0 | 4.8% |

| DOMESTIC BONDS | 123,555.4 | 34.1% |

| FOREIGN BONDS | 1,811.7 | 0.5% |

| MORTGAGES | 7,246.7 | 2.0 |

| REAL ESTATE | 14,131.0 | 3.9% |

| CANADIAN EQUITIES | 119,569.7 | 33.0% |

| U.S. EQUITIES | 30,073.6 | 8.3% |

| INTERNATIONAL EQUITIES | 45,291.6 | 12.5% |

| OTHER ASSETS | 3,261.0 | 0.9% |

| TOTAL ASSETS AT MARKET | 362,332.7 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $365,363.5 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1995

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 17,084.9 | 5.4% |

| DOMESTIC BONDS | 119,594.5 | 37.8% |

| FOREIGN BONDS | 1,581.9 | 0.5% |

| MORTGAGES | 7,593.3 | 2.4 |

| REAL ESTATE | 12,339.1 | 3.9% |

| CANADIAN EQUITIES | 93,018.0 | 29.4% |

| U.S. EQUITIES | 25,627.4 | 8.1% |

| INTERNATIONAL EQUITIES | 36,068.2 | 11.4% |

| OTHER ASSETS | 3,480.3 | 1.1% |

| TOTAL ASSETS AT MARKET | 316,387.6 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $317,585.2 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1994

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 17,823.4 | 6.9% |

| DOMESTIC BONDS | 100,809.1 | 38.8% |

| FOREIGN BONDS | 1,416.6 | 0.5% |

| MORTGAGES | 7,817.5 | 3.0 |

| REAL ESTATE | 12,339.1 | 3.9% |

| CANADIAN EQUITIES | 72,814.9 | 28.0% |

| U.S. EQUITIES | 18,032.4 | 6.9% |

| INTERNATIONAL EQUITIES | 28,018.2 | 10.8% |

| OTHER ASSETS | 3,112.5 | 1.3% |

| TOTAL ASSETS AT MARKET | 259,740.5 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

** TOTAL ASSETS OF ALL FUNDS $270,272.1 MILLION

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1993

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 16,641.2 | 6.5% |

| GOV'T AND GUARANTEED BONDS | 70,745.6 | 27.7% |

| CORPORATE BONDS | 33,470.2 | 13.1% |

| FOREIGN BONDS | 852.0 | 0.3% |

| MORTGAGES | 7,983.3 | 3.1% |

| REAL ESTATE | 8,630.1 | 3.4% |

| CANADIAN EQUITIES | 70,634.6 | 27.6% |

| U.S. EQUITIES | 15,794.8 | 6.2% |

| INTERNATIONAL EQUITIES | 21,903.5 | 8.6% |

| OTHER ASSETS | 9,119.7 | 3.6% |

| TOTAL ASSETS AT MARKET | 255,775.0 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1992

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 12,005.3 | 5.9% |

| GOV'T AND GUARANTEED BONDS | 81,772.5 | 40.0% |

| CORPORATE BONDS | 17,655.5 | 8.6% |

| FOREIGN BONDS | 390.5 | 0.2% |

| MORTGAGES | 7,945.2 | 3.9% |

| REAL ESTATE | 7,887.6 | 3.9% |

| CANADIAN EQUITIES | 50,831.6 | 24.9% |

| U.S. EQUITIES | 12,315.2 | 6.0% |

| INTERNATIONAL EQUITIES | 11,932.1 | 5.8% |

| OTHER ASSETS | 1,563.8 | 0.8% |

| TOTAL ASSETS AT MARKET | 204,299.3 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1991

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 13,741 | 6.8% |

| GOV'T AND GUARANTEED BONDS | 76,777 | 38.1% |

| CORPORATE BONDS | 7,075 | 3.5% |

| FOREIGN BONDS | 3,460 | 1.7% |

| PRIVATE BONDS | 2,101 | 1.0% |

| INSURED MORTGAGES | 3,818 | 1.9% |

| CONVENTIONAL MORTGAGES | 4,632 | 2.3% |

| REAL ESTATE | 8,084 | 4.0% |

| CANADIAN EQUITIES | 51,530 | 25.6% |

| U.S. EQUITIES | 11,239 | 5.6% |

| INTERNATIONAL EQUITIES | 9,555 | 4.7% |

| PRIVATE EQUITIES | 1,080 | 0.5% |

| TAA ACCOUNT | 480 | 0.2% |

| OTHER ASSETS | 7,725 | 3.8% |

| TOTAL ASSETS AT MARKET | 204,299.3 | 100% |

NOTE:

** TOTAL ASSETS DO NOT INCLUDE ASSETS OF NON-REPORTING FUNDS

ASSET MIX OF PLANS OF SPONSOR ORGANIZATIONS REPRESENTED BY MEMBERS AS AT DEC 31, 1990

| MILLIONS $ | PERCENT OF TOTAL | |

|---|---|---|

| CASH AND SHORT TERM | 16,635 | 9.9% |

| GOV'T AND GUARANTEED BONDS | 76,667 | 45.6% |

| CORPORATE BONDS | 5,486 | 3.3% |

| INSURED MORTGAGES | 5,931 | 3.5% |

| CONVENTIONAL MORTGAGES | 2,520 | 1.5% |

| REAL ESTATE | 7,026 | 4.2% |

| CANADIAN EQUITIES | 39,822 | 23.7% |

| U.S. EQUITIES | 7,913 | 4.7% |

| INTERNATIONAL EQUITIES | 3,795 | 2.3% |

| OTHER ASSETS | 2,196 | 1.3% |

| TOTAL ASSETS AT MARKET | 167,991 | 100% |